TAXPULSE CONSULTANTS

Keeping your

finances in Rhythm.

STRATEGIC TAX PLANNING AND BUSINESS CONSULTING

At TaxPulse Consultants, we specialize in guiding individuals and businesses through the complexities of tax planning, implementation and preparation. Our services are designed for small business owners, freelancers, and families seeking to maximize their tax efficiency and minimize liabilities.

We understand that each client's financial situation is unique, and we are committed to providing personalized strategies that align with your goals.

With our expert guidance, you can navigate the tax landscape with confidence and peace of mind.

Are you a small business owner, freelancer, or an individual seeking to maximize your tax benefits and minimize liabilities?

We know that every financial situation is unique. That’s why we offer personalized strategies tailored to your specific goals.

Our team provides year-round tax planning, not just tax preparation, helping you reduce your tax burden with smart, proactive solutions. With our up-to-date knowledge and expert guidance, you'll navigate the tax landscape confidently and save more along the way.

Let us help you achieve financial peace of mind with strategies that work for you.

Here are some features why

you should choose us

Client Satisfaction

At TaxPulse Consultants, we pride ourselves on delivering personalized tax solutions that go beyond traditional tax preparation. Our dedicated team works closely with individuals and businesses to navigate the complexities of tax planning, implementation, and preparation. We are committed to understanding your unique financial goals and crafting strategies that maximize savings while ensuring full compliance.

Our clients' satisfaction stems from our ability to offer expert advice, proactive tax strategies, and peace of mind—knowing that their financial future is in trusted hands. We measure our success by the success of those we serve.

Expert Guidance

Our services are tailored to meet the diverse needs of small business owners, freelancers, and families who seek to optimize their tax efficiency and minimize liabilities. At TaxPulse Consultants, we provide expert guidance rooted in deep industry knowledge and a proactive approach to tax strategy. From identifying valuable deductions to navigating complex tax laws, we equip our clients with the tools and insights they need to make informed decisions and keep more of what they earn.

With our expertise, you can feel confident knowing that your tax strategy is designed to support long-term financial success.

Who We Are

At Tax Pulse Consultants, we are committed to providing top-notch tax planning, preparation, and implementation services, customized to address the distinct needs of individuals, families, freelancers, and businesses alike. Our approach is built on a foundation of deep industry expertise and a proactive mindset that ensures our clients stay ahead of changing tax laws and regulations. We go beyond standard tax preparation, offering a strategic perspective designed to maximize savings and minimize liabilities.

With a highly experienced team of tax professionals, we pride ourselves on delivering more than just transactional services. We build lasting partnerships with our clients, working collaboratively to develop long-term tax strategies that align with their financial goals. Whether it’s identifying overlooked deductions, maximizing credits, or providing guidance on tax-efficient structures, our team is dedicated to ensuring every client’s tax plan is as optimized as possible.

What We Are

At TaxPulse Consultants, we believe that effective tax planning is the cornerstone of long-term financial success. Our mission is to simplify the often complex and overwhelming tax process, offering our clients clear, actionable insights that empower them to make informed decisions with confidence.

We understand that every individual and business has unique financial goals, which is why we take a personalized approach, tailoring our services to meet the specific needs of each client.

Integrity, transparency, and personalized service are the pillars of our practice. We are committed to building lasting, trusting relationships with our clients, ensuring they receive the full attention and customized care they deserve.

Whether it's strategic tax planning, preparation, or ongoing advisory services, our goal is to provide the most value possible by being proactive and forward-thinking.

WHAT WE OFFER

All the services we provide for the client

Tax Preparation

Our meticulous tax preparation services ensure accurate and timely filing of your federal, state, and local tax returns. We take the time to gather all necessary documentation and leverage available deductions and credits to minimize your tax liability.

Tax Planning

We believe that proactive tax planning is essential for financial success. Our team works with you to develop customized strategies that align with your financial goals, helping you to optimize your tax situation throughout the year.

Business Tax Services

We specialize in providing tax services for small businesses, including LLCs, corporations, and partnerships. Our offerings include: - Entity selection and formation advice - Quarterly estimated tax calculations - Business deductions and credits optimization - Year-end tax planning to maximize savings

Tax Consultation

Our tax consultation services provide you with valuable insights and advice. We offer: - One-on-one consultations to discuss your specific tax concerns - Review of prior tax returns to identify potential savings - Guidance on tax law changes and their impact on your situation

IRS Representation

If you face an audit or need to address tax issues with the IRS, our experienced team can represent you. We handle: - Correspondence with the IRS on your behalf - Audit representation and support - Resolution of tax disputes and payment plans

Estate and Trust Services

We assist clients in navigating the complexities of estate and trust taxation, including: - Estate tax planning to minimize liabilities - Preparation of estate and trust tax returns - Guidance on the tax implications of asset transfers

Tax Education and Resources

At TaxPulse Consultants, we believe in empowering our clients with knowledge.

Tax Planning Process

The TaxPulse Team will initiate the process by conducting an initial consultation with the you. This involves understanding the your specific needs, financial situation, and goals.

Whether it’s retirement planning, investment strategies, or business growth, we provide expert advice to optimize your tax position and secure a prosperous future.

01.

Review Your Financial Situation

Begin by conducting a comprehensive review of your current financial situation. This includes analyzing your income, expenses, investments, and any existing tax liabilities. Understanding your financial landscape allows you to identify potential tax-saving opportunities and areas for improvement.

02.

Develop a Tax Strategy

Create a tailored tax strategy that incorporates various tax-saving techniques. This may include leveraging tax deductions, credits, retirement account contributions, or investment strategies. A well-thought-out strategy will help optimize your tax position while staying compliant with tax laws.

03.

Set Your Tax Goals

Define your specific tax goals based on your financial review. Consider objectives such as minimizing tax liability, maximizing deductions, or planning for future tax implications. Clear goals will help shape your tax strategy and ensure alignment with your overall financial objectives.

04.

Implementation

Put your tax strategy into action. This involves executing the planned steps, such as making necessary financial adjustments, filing appropriate forms, and maintaining accurate records. Regularly monitor and adjust your strategy as needed to adapt to any changes in your financial situation or tax regulations.

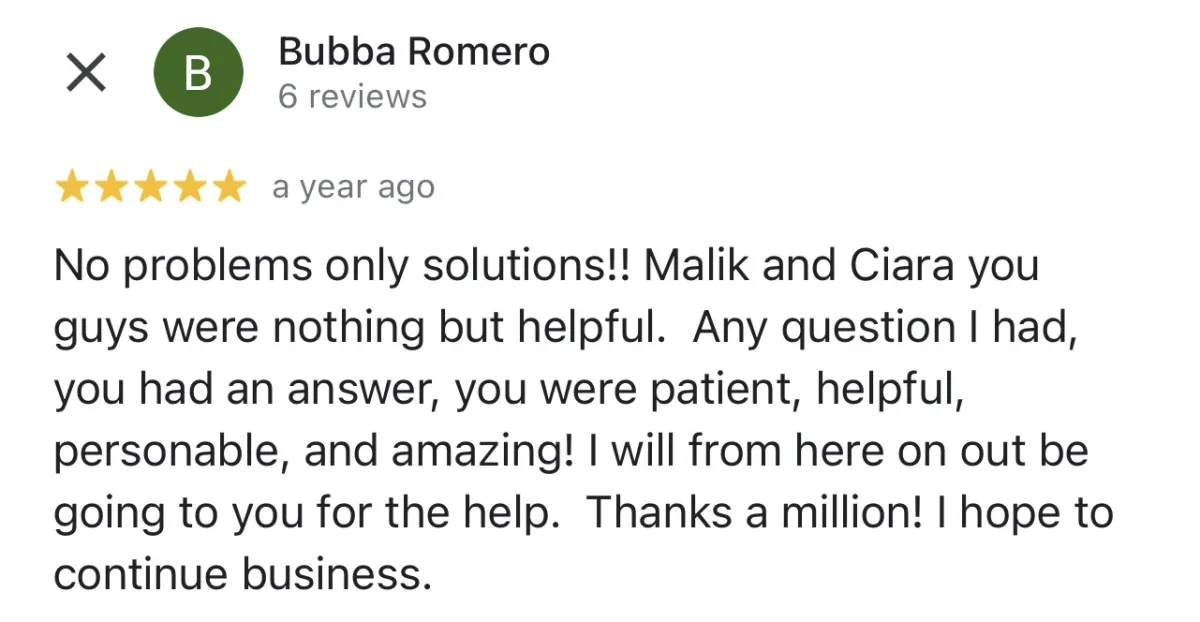

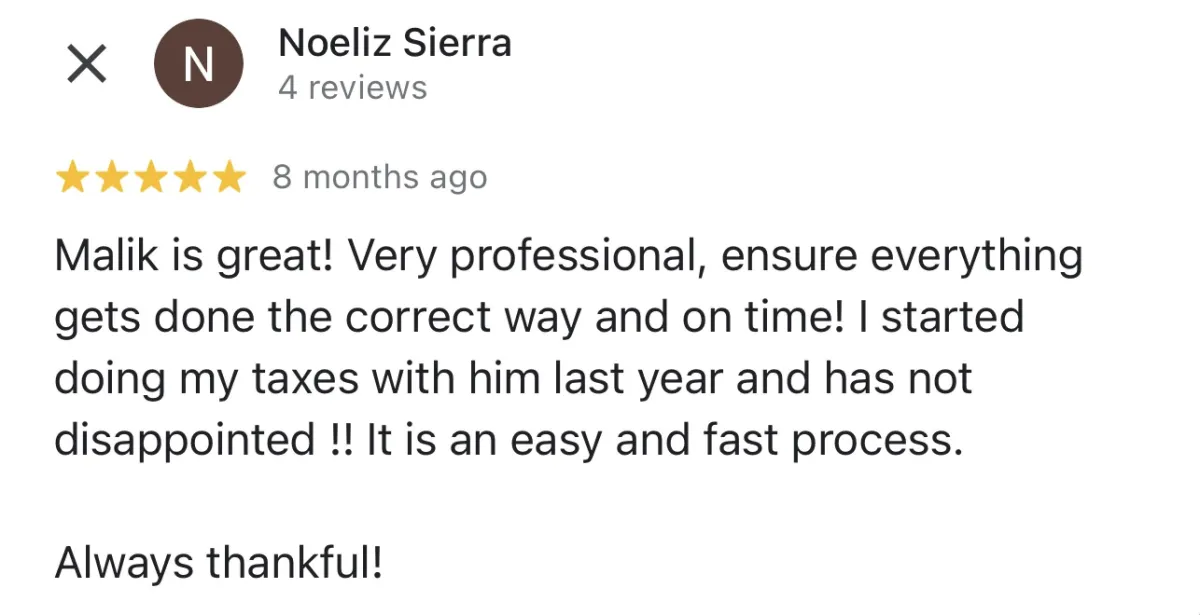

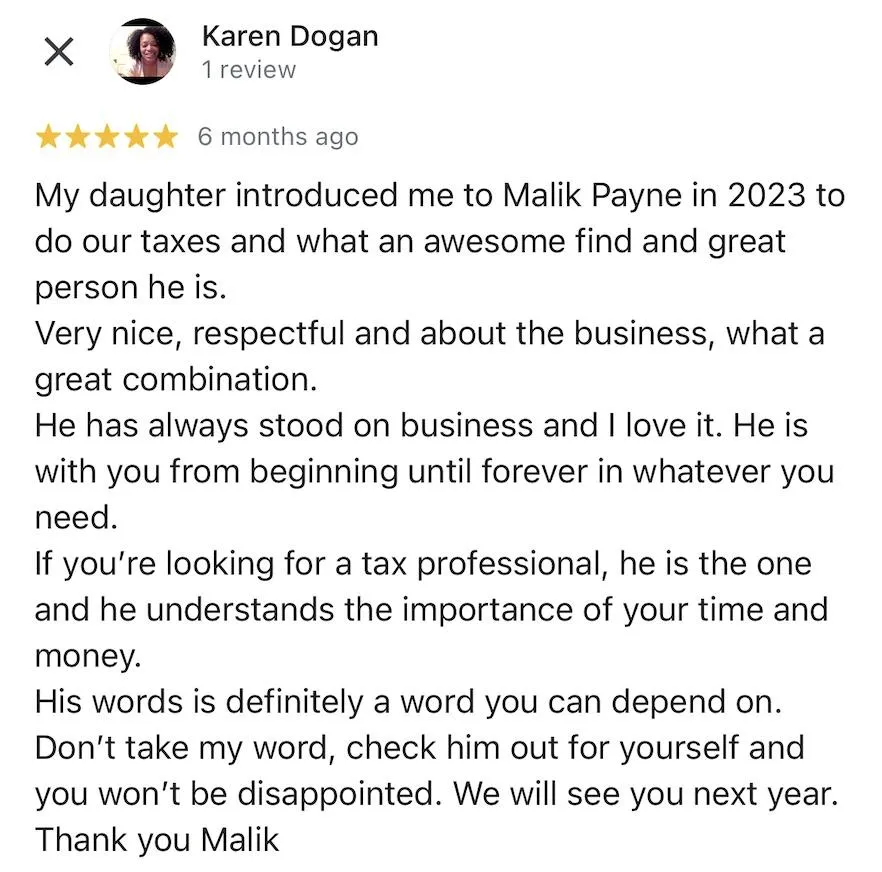

What Customers Think About Us

Get more out of your business

discover insights with our resources on

taxes, strategies, wealth, and business

Frequently Asked Questions

Question 1: What services do you offer?

We provide tax planning, implementation and preparation for individuals and businesses. Please visit our services page to view our full list of services provided.

Question 2: How can I schedule a consultation?

You can schedule a consultation by contacting us through our website or [email protected].

Question 3: What documents do I need to bring for my tax appointment?

Please bring your W-2s, 1099s, any relevant financial documents, and previous tax returns.

Question 4: How do you ensure my information is secure?

We use industry-standard security measures to protect your personal and financial information.

Question 5: What are your fees?

Our fees vary based on the complexity of your tax situation. Contact us for a personalized quote.

Question 6: When is the best time to start preparing my taxes?

We recommend starting your tax preparation as early as possible to avoid last-minute stress.

Question 7: Do you offer year-round support?

Yes, we provide ongoing support and consultation throughout the year for all your tax needs.

Question 8: Can you represent me in case of an audit?

Yes, we offer audit representation services to assist you during the process.